Survey shows concerns among clinicians and industry

Clinical ophthalmologists have a lot on their minds, and so do the industry leaders that provide the tools they use, a new survey suggests. The findings come from a survey of 203 pre-registered attendees of the ESCRS iNovation Day meeting this past Friday.

Ophthalmologists and industry representatives both cited increased regulation and decreasing reimbursement as major concerns. Non-doctors showed an elevated concern for supply chain issues, while doctors showed slightly more concern about more economic issues—recession and inflation. Interestingly, neither doctors nor non-doctors appeared to have major concerns about COVID restrictions or resurgence.

The survey highlighted some surprising contrasts among the concerns of small companies versus larger companies. While both groups expressed ongoing concern about increased regulation, larger companies were somewhat more concerned about supply chain issues, whereas smaller companies were more concerned about finding and keeping employees than their larger counterparts.

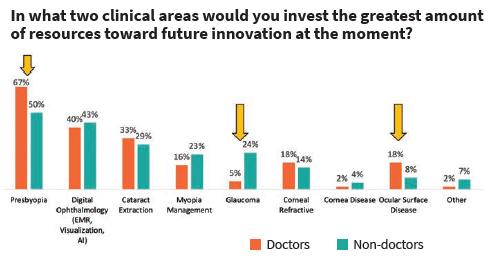

When asked, “What two areas would you invest the greatest amount of resources toward future innovation?”, clinicians put presbyopia at the top of the list, followed by digital ophthalmology (EMR, visualisation, AI) and cataract extraction. The industry response was similar, but with a greater emphasis on glaucoma.

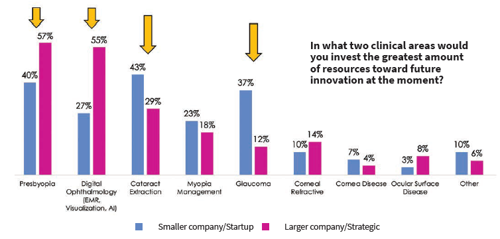

Large and small companies showed some divergence when asked the same question. Larger companies expressed a greater interest in developing presbyopia and digital ophthalmology resources, and smaller companies appeared to be more interested in developing glaucoma treatments.

Overall, smaller companies appeared to be significantly more optimistic than larger companies. Two-thirds of the smaller companies believe investment in ophthalmic innovation will either increase or significantly increase between 2022 and 2023, compared to slightly more than half of the larger companies. Some 14% of larger companies expressed concern about decreasing investment in the next year compared with 7% of the smaller companies.

The eighth annual ESCRS Clinical Trends Survey is underway. That survey asks ESCRS members key questions on current issues they face in their practices. As the name suggests, it also shows which procedures are gaining in popularity and which are fading, and why.

Latest Articles

Towards a Unified IOL Classification

The new IOL functional classification needs a strong and unified effort from surgeons, societies, and industry.

Organising for Success

Professional and personal goals drive practice ownership and operational choices.

Update on Astigmatism Analysis

Is Frugal Innovation Possible in Ophthalmology?

Improving access through financially and environmentally sustainable innovation.

iNovation Innovators Den Boosts Eye Care Pioneers

New ideas and industry, colleague, and funding contacts among the benefits.

José Güell: Trends in Cornea Treatment

Endothelial damage, cellular treatments, human tissue, and infections are key concerns on the horizon.

Making IOLs a More Personal Choice

Surgeons may prefer some IOLs for their patients, but what about for themselves?

Need to Know: Higher-Order Aberrations and Polynomials

This first instalment in a tutorial series will discuss more on the measurement and clinical implications of HOAs.

Never Go In Blind

Novel ophthalmic block simulator promises higher rates of confidence and competence in trainees.